|

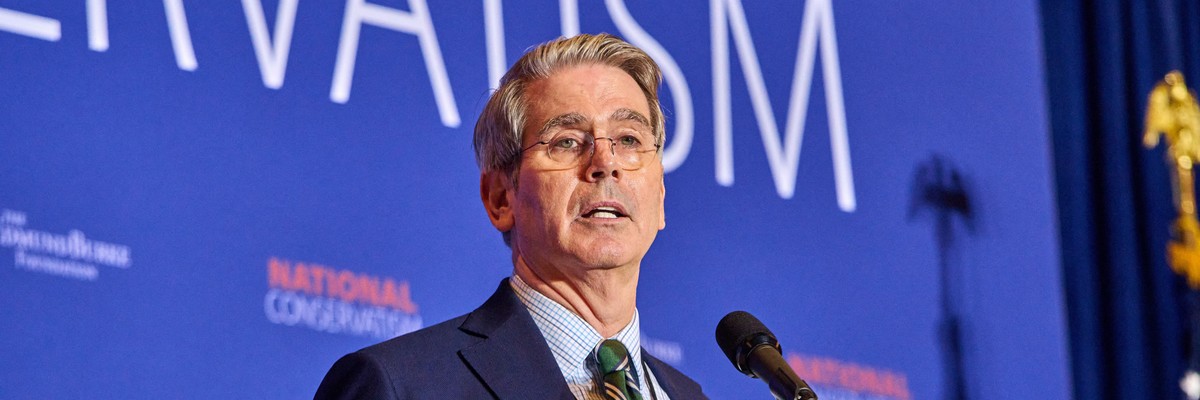

Scott Bessent speaks at the National Conservative Conference in Washington D.C. on July 10, 2024. (Photo: Dominic Gwinn/Middle East Images/Middle East Images/AFP via Getty Images) |

With the stock market surging Monday morning after U.S. President-elect Donald Trump's nomination of hedge fund manager Scott Bessent to be treasury secretary, some Wall Street executives said they were celebrating a "reasonable" pick who would moderate some of Trump's most extreme proposals.

But economic justice advocates and experts said the jubilation was likely over expectations that Bessent will deliver "trillions in tax cuts to the ultra-wealthy."

Jeffrey Sonnenfeld, founder and president of the Yale Chief Executive Institute, toldCNN that the billionaire Key Square Group executive is a "pragmatic" choice who supports only "selective tariffs" and could dial back Trump's plan to introduce across-the-board tariffs of up to 20% on imported goods—a plan that economists say would raise prices for U.S. households.

But Bessent himself told radio host Larry Kudlow on Saturday that tariffs "can't be inflationary."

David Kass, executive director of the economic justice group Americans for Fair Taxation (ATF), said that during Bessent's confirmation process, the organization will work to ensure lawmakers get answers to questions about whether the Wall Street billionaire plans to use tariffs to fund another Trump plan Bessent has endorsed: the renewal of the 2017 tax cuts.

"As income inequality is soaring and Americans are being crushed by the rising costs of living, we have to ask why billionaire Scott Bessent supports renewing the Trump tax bill, which gives trillions in tax cuts to the ultra-wealthy and mega-corporations," Kass said. "Moreover, we also need to know how Mr. Bessent would fund this massive tax giveaway. Will he make working and middle-class Americans foot the bill by enacting wide-ranging cuts to vital government programs like Social Security and Medicare? Will he squeeze Main Street by raising prices on essential goods through tariffs?"

The government watchdog Accountable.US noted that Bessent has defended Trump's tariff plan, which analysts found would raise annual household costs by an average of $3,900, while backing the extension of Trump's tax plan, which overwhelmingly benefited the wealthy and corporations.

"For all his talk of looking out for working-class Americans, President-elect Trump's choice of a billionaire hedge fund manager to lead the Treasury Department shows he just wants to keep a rigged system that only works for big corporations and the very wealthy," said Accountable.US executive director Tony Carrk. "If confirmed, Scott Bessent's first order of business will be to push trillions of dollars in more tax giveaways to the very well-off and at the same time essentially enact a $3,900 tax increase for the typical American family."

"This is yet another disastrous cabinet nomination by Donald Trump, and a further indication of the administration's plans for massive giveaways to the superrich and slashing of regulatory safeguards that guarantee the well-being of the American people."

As the Dow Jones Industrial Average surged by 500 points on Monday, National Association of Manufacturers CEO Jay Timmons told CNN that Bessent is likely to try to rein in what he called President Joe Biden's "out-of-control government spending." Republican leaders have signaled that with the GOP set to control both chambers of Congress as well as the White House starting in January, the party is likely to try to make cuts to Medicare and Social Security—long derided by the right as too expensive and wasteful.

"Wall Street may be breathing a sigh of relief at Scott Bessent's nomination, but working people see no help coming their way," Sen. Elizabeth Warren (D-Mass.), who is set to be the highest-ranking Democrat on the Senate Banking Committee, said Monday. "Mr. Bessent's expertise is helping rich investors make more money, not cutting costs for families squeezed by corporate profiteering."

Earlier this year, Bessent told his clients at Key Square Group that a second Trump turn would mean an "economic lollapalooza" for them, with the Republican lowering taxes for his wealthy investors and bringing about an era of deregulation.

The Republican megadonor has proposed a "3-3-3" policy approach to Trump, which would include cutting the budget deficit by 3% by 2028, boosting GDP growth by 3%, and urging Big Oil to produce another 3 million barrels of crude oil per day.

Bessent has also expressed support for Trump's embrace of the cryptocurrency industry, which poured more than $110 million into federal election spending this year and spent an all-time high of $24.7 million on anti-regulatory lobbying in 2023.

Brad Garlinghouse, CEO of financial tech firm Ripple, said Friday that he expects Bessent to be "the most pro-innovation, pro-crypto treasury secretary we've ever seen." Critics have warned that the unregulated and highly speculative crypto industry has little to offer working people.

"America doesn't need a hedge fund executive to lead its economic policymaking, least of all one under the delusion that tax cuts for the rich, rollbacks of public regulatory protections, and an increase in oil drilling is somehow the way to strengthen the nation's economy," said Robert Weissman, co-president of consumer advocacy group Public Citizen. "This is yet another disastrous cabinet nomination by Donald Trump, and a further indication of the administration's plans for massive giveaways to the superrich and slashing of regulatory safeguards that guarantee the well-being of the American people."

Despite some proponents' claims that Bessent is a more mainstream pick than some other names that were floated for treasury secretary, Carrk said the nomination is from "the same old playbook, and it will have the same results of an economy that only works for a select few, not everyone."